top of page

Search

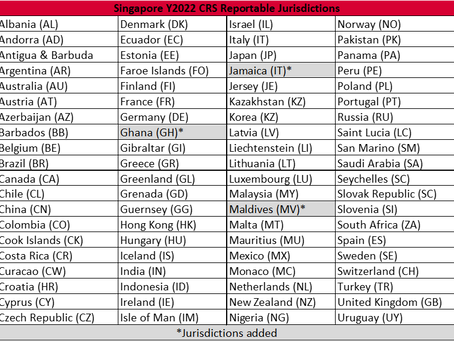

Singapore Updates CRS Reportable Jurisdictions

The Inland Revenue Authority of Singapore (IRAS) published its updated list of reportable jurisdictions on February 1, 2023. It has added...

Elizabeth A. McMorrow

Feb 1, 2023

Singapore Updated FATCA Reporting Form

On December 20, 2022, the Inland Revenue Authority of Singapore (IRAS) updated its FATCA Fillable PDF Form. Specifically, IRAS updated...

Elizabeth A. McMorrow

Dec 23, 2022

Singapore Updated FATCA TIN Reporting FAQ

On February 23, 2022, the Inland Revenue Authority of Singapore (IRAS) updated its IRAS FAQs on the Foreign Account Tax Compliance Act...

Elizabeth A. McMorrow

Feb 23, 2022

Singapore Increased FATCA/CRS Penalties

Singapore recently increased the penalties for both FATCA and Common Reporting Standard (CRS) non-registration and non-filing offenses....

Elizabeth A. McMorrow

Dec 21, 2021

FATCA: Prepare for Singapore 2020 Changes

As promised in July, Singapore provided details regarding changes to FATCA reporting requirements. The changes take effect as of April...

Elizabeth A. McMorrow

Oct 9, 2019

FATCA: Head’s Up 3301 Registered Singapore FIs

Singapore released its FATCA reporting nil paper form yesterday. The Inland Revenue Authority of Singapore (IRAS) requires nil reporting...

Elizabeth A. McMorrow

Apr 17, 2018

CRS: Singapore’s Updated Portal & Reportable Jurisdictions

The Singapore tax authority (Inland Revenue Authority of Singapore (IRAS)) announced that it has updated the services available in its...

Elizabeth A. McMorrow

Feb 13, 2018

CRS & FATCA: Singapore Sub-Fund Deregistration & Service Provider Limitations

The Inland Revenue Authority of Singapore (IRAS) issued a reminder to financial institutions that an entity that is or becomes a...

Elizabeth A. McMorrow

Nov 24, 2017

Singapore Released Its FATCA Reporting Nil Paper Form

Singapore released its FATCA reporting nil paper form today. The Inland Revenue Authority of Singapore (IRAS) requires nil reporting...

Elizabeth A. McMorrow

Apr 3, 2017

bottom of page